Story

Summary

Skills and Tools

Education

Experience

Library

NYC Dept of Social Services

NYC Dept of Design and Construction

Little Black Book for managing your dates

Website: Tecnomatic

Experience Design

NYC Dept of Consumer and Worker Protection

Website: Chris and Amy say I do

Website: Fierce & Fabulous

Splor Exploration and Discovery App

Highland Park Tennis

Trending tactics

Must I wear this tech

NYC Dept of Youth and Community Development

Stop learning to code

Casualties of the business tech wars

VozSays Mobile Polling Platform

Public spheres in private ecosystems

A waste of time

Commitments to Yourself

HTML Lectures

CSS Lectures

Hunter College

NYC Dept of Consumer and Worker Protection

Client: NYC Deptartment of Consumer and Worker Protection DCWP

The NYC Department of Consumer and Worker Protection protects and enhances the daily economic lives of New Yorkers to create thriving communities. DCA licenses more than 75,000 businesses in more than 50 industries and enforces key consumer protection, licensing, and workplace laws that apply to countless more.

FCA - Financial Consumer App

Roles: Researcher, Analyst, Designer, Developer View Prototype

The financial consumer app helps counselors schedule, record, and monitor the personal finances of NYC residents who need help getting control of their finances. By working with financial counselors and social planners, FCA helps counselors and clients with various financial tools that help balance a budget, improve credit, create a financial plan, and much more.

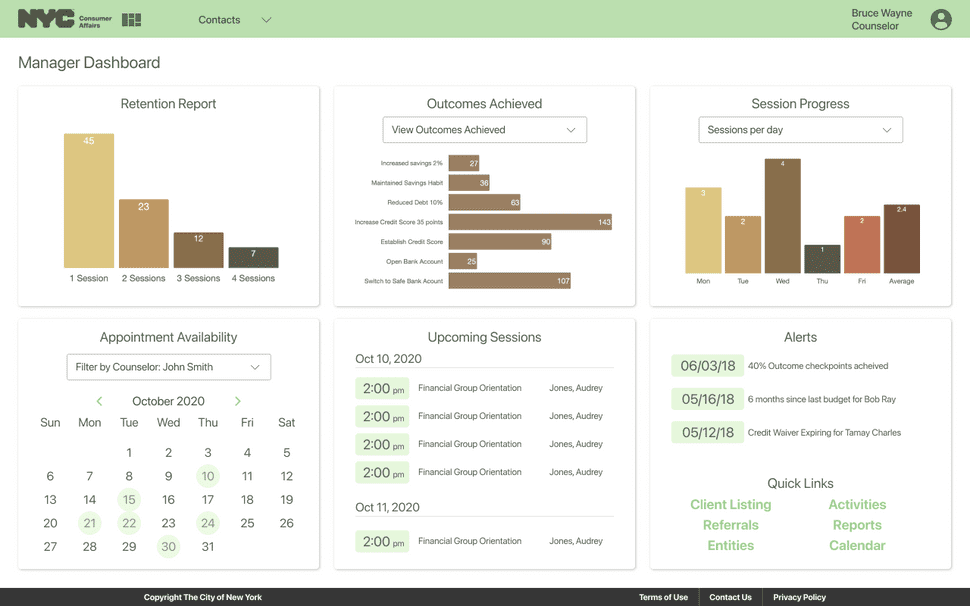

The DCWP financial consumer app measures the performance of counselors across different agencies to see how they well they are helping NYC residents meet city outcomes and standards to help improve their finances. The dashboard is where managers can get a sense of how best to help city residents who tend to face dire financial straits.

Manager Dashboard could be set up and customized to match user preferences, and show what

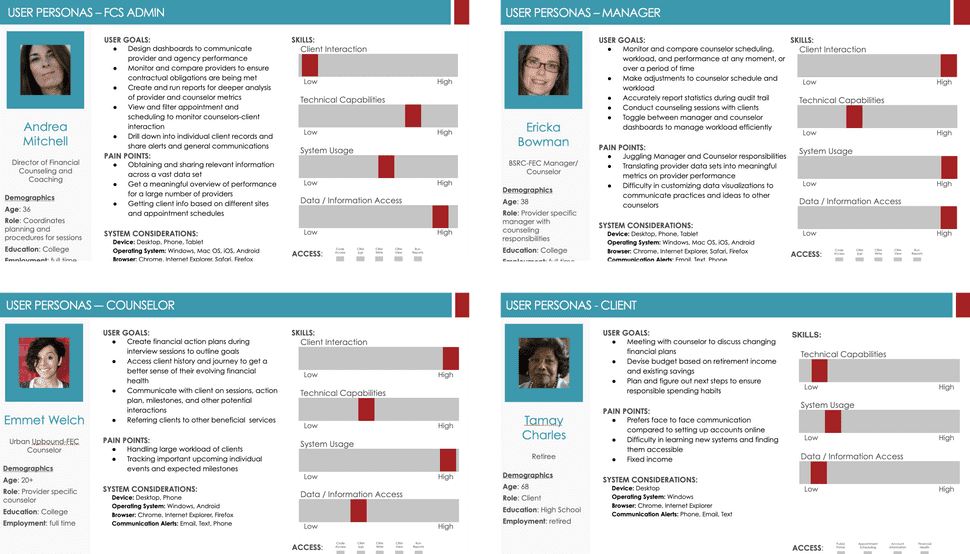

Many user roles need to be considered for FCS to properly handle the needs of DCWP. Personas and behaviors were considered for administrators, vendor managers and workers, counselors and assistants, and of course the clients who rely on the city to offer proper interventions that will improve their finances.

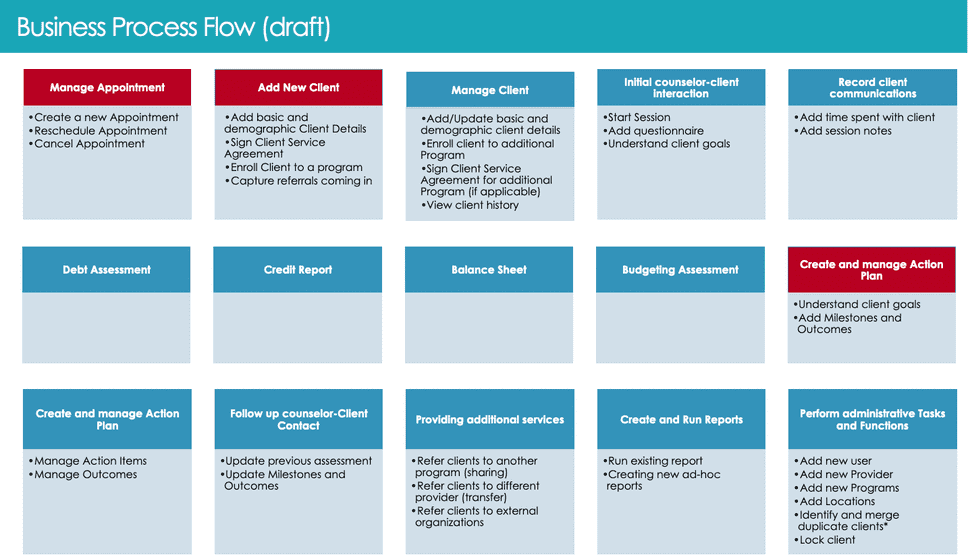

The challenge of working with any agency is understanding the business processes that make its foundation, seeing where the application fits to support those processes, and support its inevitable change. Counselors use a mix of protocol and their knowledge to gather information on their clients and offer the best actionable advice.

Persona summaries for administrators, counselors, and clients to help better understand context and intent for the various people impacted by the FCA application

A high-level overview of all the expected processes and procedures that go into managing and administrating financial counseling sessions

Managing Clients

The main purpose of the FCA is to help the counselor improve their client's finances. A fully-featured client screen is central to that goal, so the client can gather information, or make interventions that help. Each client has their information, custom notes, alerts, assessments, plans, credit details, debts, financial tools, and documents.

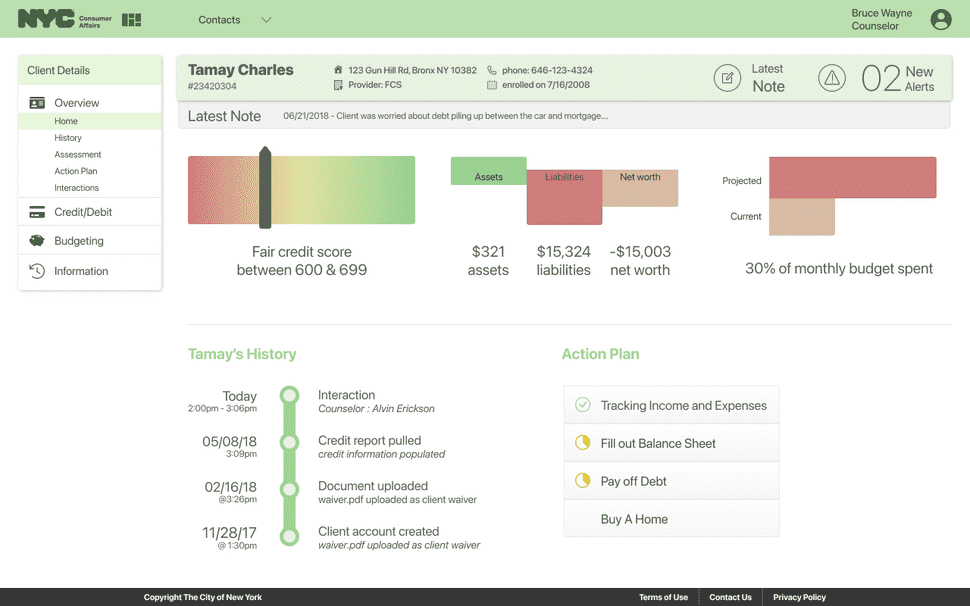

Every client has a home page they can reference to give a quick overview of their financial health. Basic general financial information can be found along with side counseling support tools and information. So you can find information on credit score, balance sheet, and budgeting details next to high-level details about the client's history and action plan.

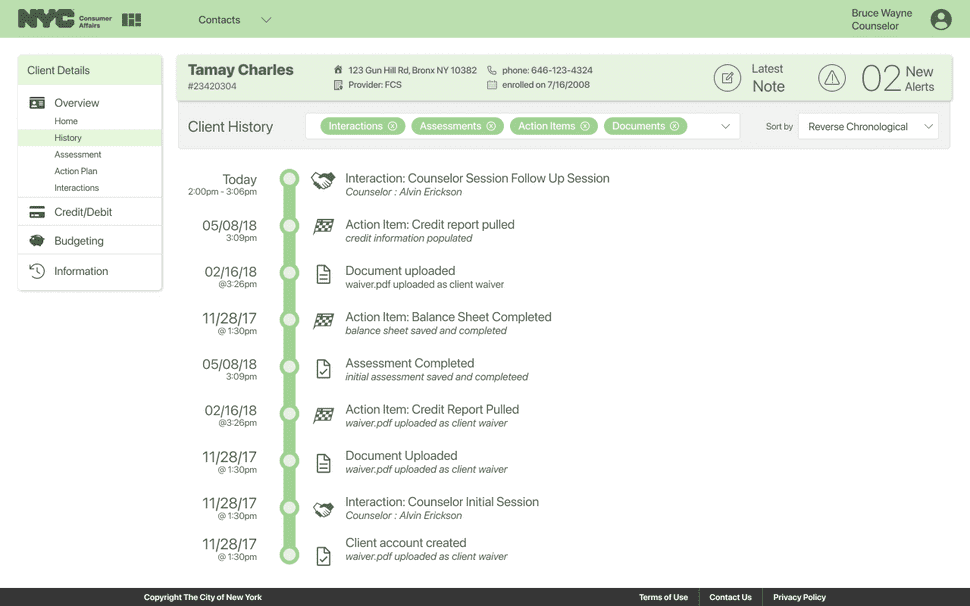

Client history is meant to detail all the interactions, assessments, action items, and documents exchanged with the counselor. Sorting these history items makes it easy to find any particular piece of data, while a full view of all these events tell the story about how their financial background has evolved

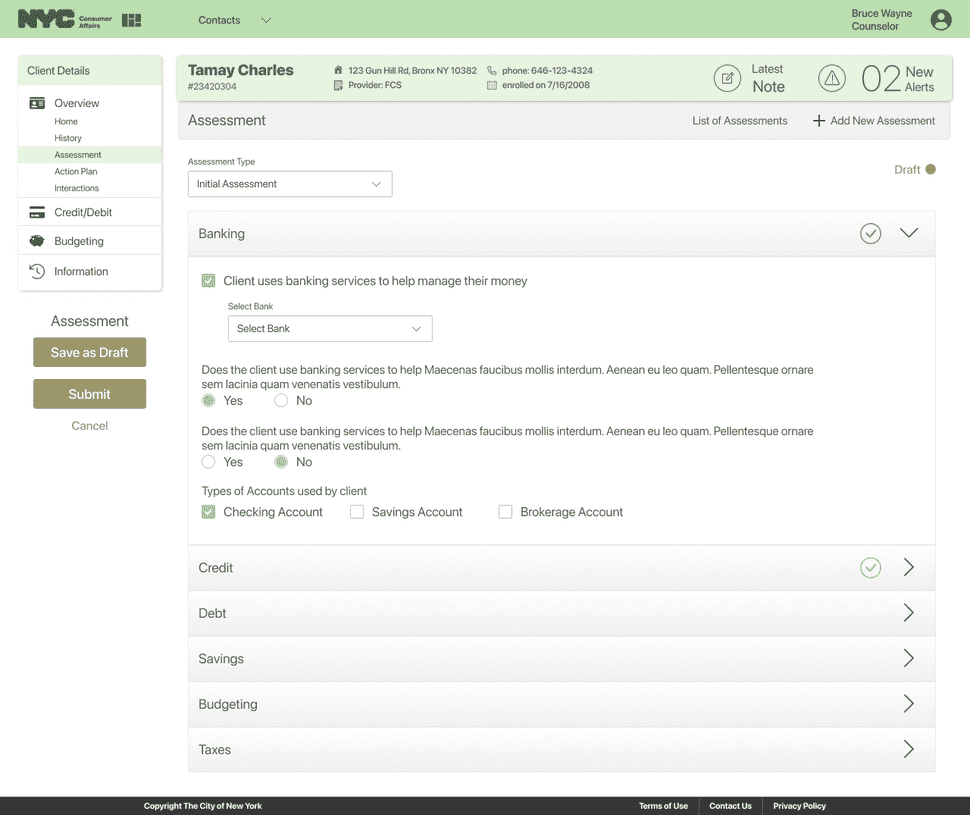

Clients can complete assessments to get a basic sense of their financial literacy and establish a baseline understanding of their finances. Initial and follow up assessments dig deeper into the client's debt, banking, credit reports, savings, budgeting, and tax information

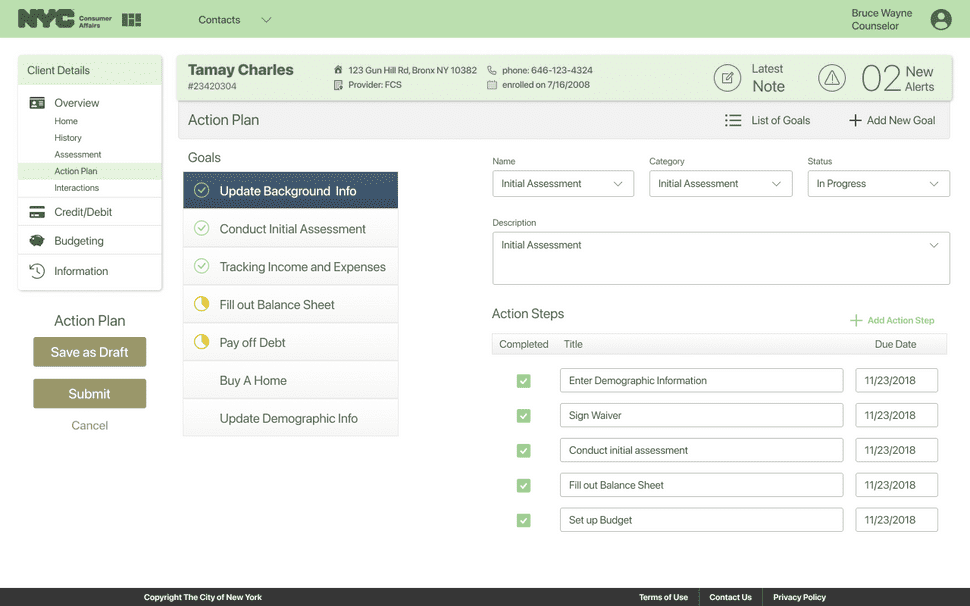

After completing assessments, counselors can devise action plans with their clients to help get them on the right track. They can set up and categorize larger goals which have smaller action steps that help encourage improvement

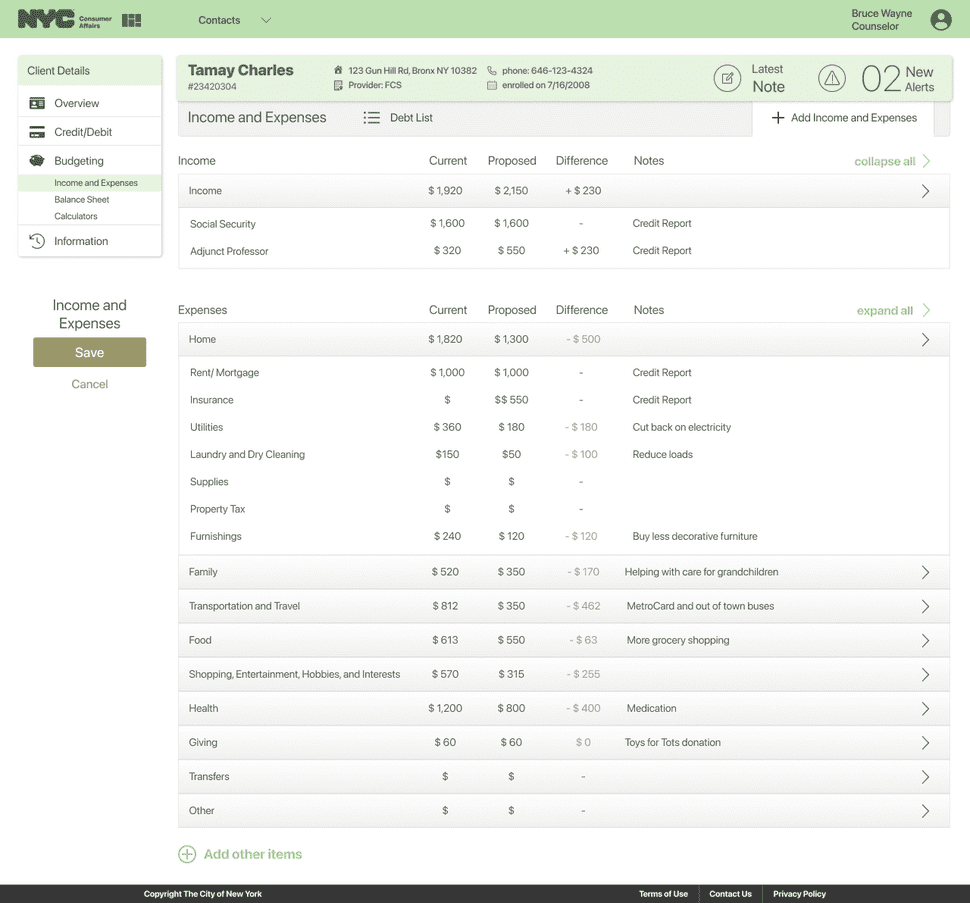

Budgeting tools and calculators

To help clients get a fuller picture of their financial standing, they can use various budgeting tools that help manage incomes, expenses, assets, and liabilities.

During sessions, counselors would discuss incomes and expenses with their clients to get a sense of how much they are spending and propose new ways in which they can be saving

These tools are meant to complement a financial counseling session rather than replace it. Often when people need help with their finances, they lose track of where their money is going. Listing out the expense and asset categories help the client confirm how they are spending and saving their money.

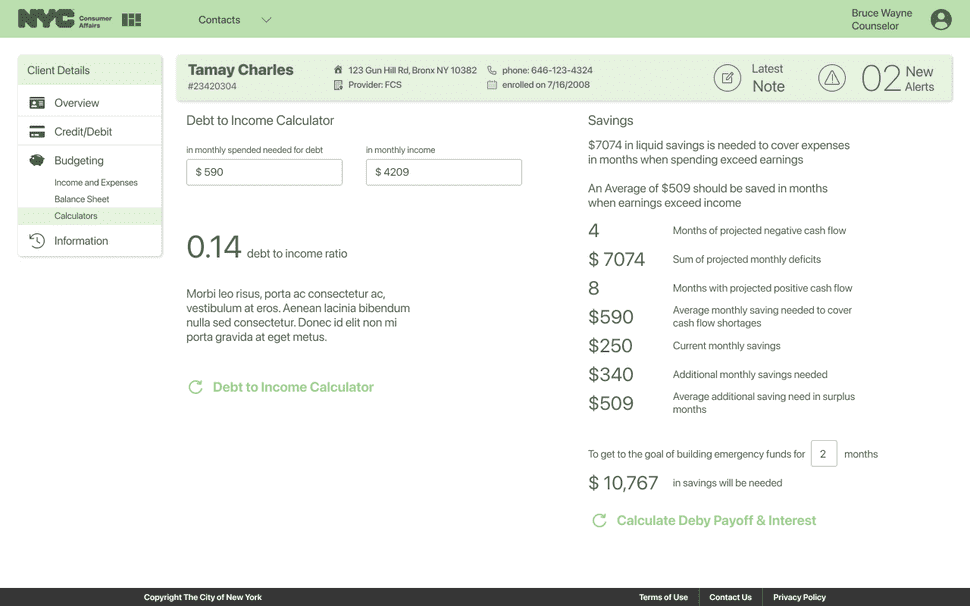

*Perform calculations to understand the current debt to income ratio along with the amount in savings needed to cover their monthly expenses. With this information, counselors can modify their action plan to increase savings and reduce debt, and ultimately enhance the client's financial stability, and literacy.

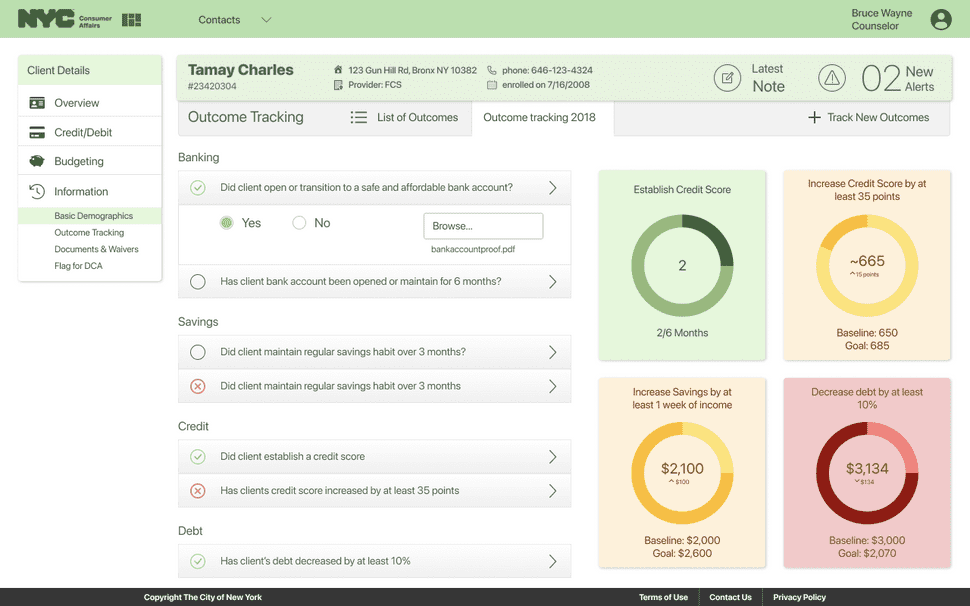

Client Information and Outcome tracing

Drill down to get further information about the client's background information and standing. In the client's information section, you can view basic demographic details, track outcomes, view previous documents and waivers that were submitted by the client, or flag for referrals to other services and programs within the agency

Counselors ask their clients questions about their current financial circumstances and see if any progress was made towards city-mandated goals.

After pulling credit reports, entering budgeting information, and devising an action plan for the client, financial counseling agencies need to track their outcomes and meet certain metrics to ensure they receive funding from the city.